We’ve pulled together a snapshot from last night’s 2022 Federal Budget announcement to highlight who will be receiving a bit of a boost to their back pocket in the Treasurer’s latest budget.

It has been another turbulent year with disruptions a plenty – covid, the war in Ukraine, and a number of natural disasters here on our own soil. As a result, we’ve seen the cost of goods skyrocket and it’s safe to say the average Australian has most likely been feeling the pinch.

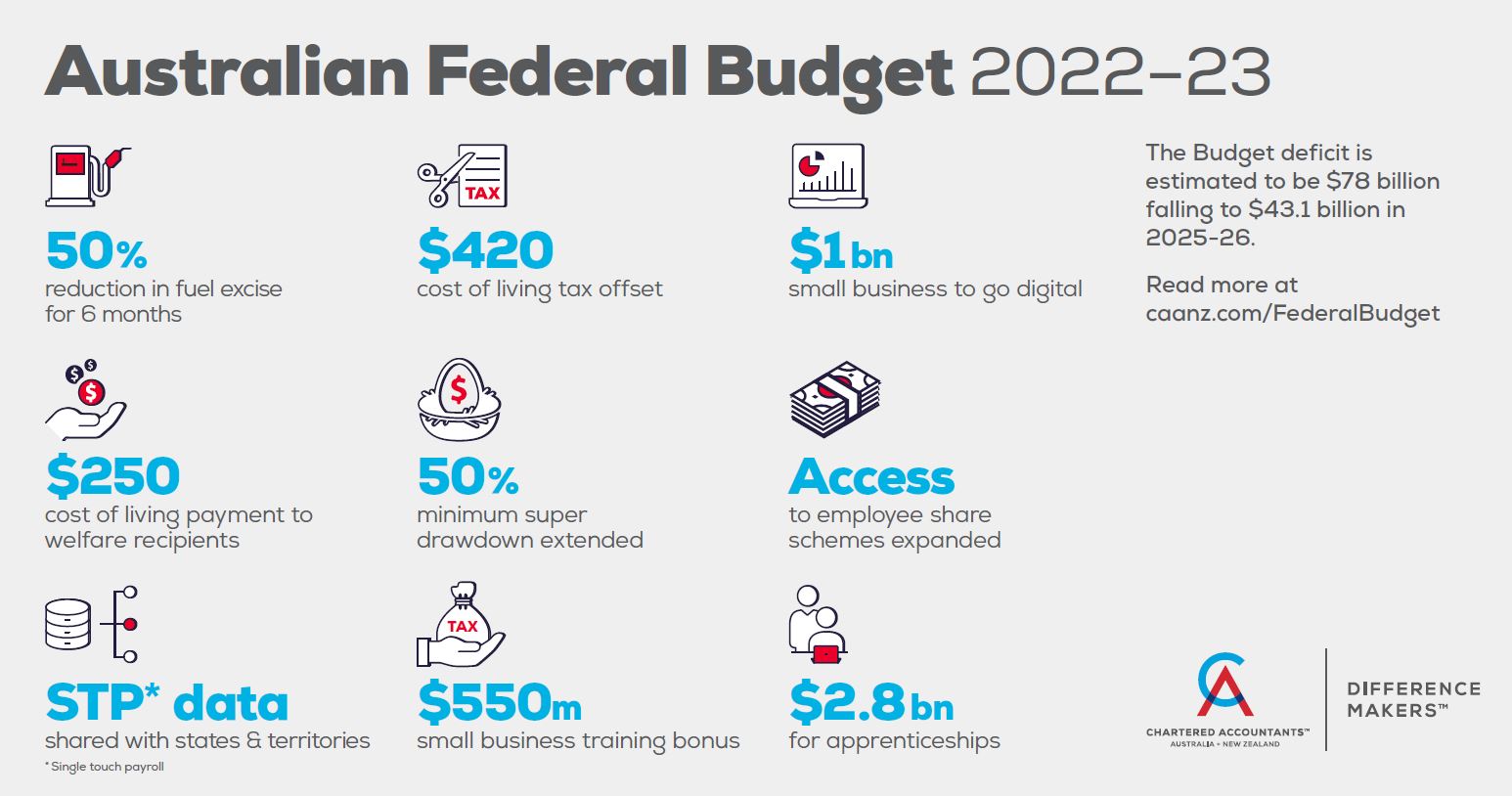

Despite this, Treasurer Josh Frydenberg assures that our economy has rebounded strongly, outperforming all other advanced economies, following what has been the biggest economic shock since the Great Depression. The 2022-23 Federal Budget deficit is estimated to be $78 billion falling to $43.1 billion in 2025-26.

The Winners

MOTORISTS: 50% reduction in fuel excise for 6 months

In recent weeks we’ve seen fuel prices skyrocket – a result of the war in Ukraine and increased oil prices. The government has announced they will half the fuel excise (i.e. the tax we pay on fuel) to 22 centre per litre for the next 6 months in an effort to bring fuel prices back down.

In a welcomed move, it appears there will also be close eyes on fuel retailers from the Australian Competition and Consumer Commission (ACCC) to ensure the intended savings are passed on to consumers. What happens after 6 months if fuel prices remain high is anyone’s guess.

LOW-MIDDLE INCOME TAX PAYERS: $420 cost of living tax offset

In an effort to ease the increasing cost of living, the government has announced a $420 tax offset for low to middle income earners.

This applies to your 2022 tax return, so you’ll get it when you lodge this year.

The low and middle tax offset announced in last year’s budget has also been extended for another year, which could see you taking home up to $1,500 this tax time.

SMALL BUSINESSES: $1bn to encourage small businesses to go digital & $550m Small Business training bonus

The government has announced a 20% deduction on the cost of expenses and depreciating assets that support a small businesses digital uptake (This applies to businesses with an annual turnover of less than $50m and includes portable payment devices, cyber security systems or subscriptions to cloud-based services).

An additional 20% deduction has been flagged for training expenses incurred by small businesses. The details aren’t yet clear when it comes to what training will actually qualify, but early suggestions are that you will need to be a registered training organisation (i.e. it’s not clear yet if industry conferences, software training etc will qualify).

Both 20% measures apply from today; however, you won’t be able to claim them until you lodge your 2023 tax return. This will require good record keeping to avoid the 20% going straight to extra administrative expenses. We’ll await guidance on what is an eligible expense in this space – the ‘savings’ to business will be roughly 5% – e.g. if you spend $1000 you’d claim $1200 (an extra $200) at the small company tax rate of 25% the extra $200 would result in $50 of additional tax savings.

APPRENTICES: $2.8bn for apprenticeships

In an effort to encourage businesses to create more apprenticeship positions, the government has developed a new incentive scheme, which looks to reward both the employer and the employee.

Under the new Australian Apprenticeships Incentive Scheme, employers are being offered the following wage subsidies:

- first and second-year apprentices = 10% subsidy

- third year apprentices = 5% subsidy

It’s important to note that this scheme is available to “priority” occupations only (which has not yet been elaborated on).

If you’re a business looking to hire an apprentice for a role that does not make the priority list, you may still be eligible for a once-off payment of $3500.

New apprentices in “priority” occupations are the winners here and will be happy to learn they’ll receive payments up to $5,000 over their first two years.

While the new scheme does aim to balance the incentives between employer and employee, unfortunately it’s not as enticing for businesses as the current Boosting Apprenticeship Commencement scheme. The current scheme, which will conclude on 30th June, offers employers a 50% wage subsidy for first year apprentices (up to $28,000). It then tapers off in the following years.

WELFARE RECIPIENTS: $250 cost of living payment to welfare recipients

Eligible pensioners, veterans, welfare recipients and eligible concession card holders will receive a bonus tax free payment of $250 next month to help ease the cost of living. This is a once-off payment and will be paid automatically to those who are eligible.

Some extra points to note

50% minimum super drawdown extended

The 50% minimum super drawdown requirements for account-based pensions has been extended for another year.

With interest rates remaining low many retirees will be happy with this measure.

Employee Share Schemes access expanded

Access to employee share schemes will be expanded, and the Government will look to reduce red tape.

STP data shared with states and territories

In an effort to enable payroll tax returns to be pre-filled with STP data (reducing compliance costs for businesses), the Government has announced a $6.6m investment in IT infrastructure to allow the ATO to share single touch payroll (STP) data with states and territories.

How this rolls out will be interesting; the government isn’t known for seamless technology rollouts. There has been talk of further digitising business and enabling government departments to gather ‘real time’ information such as calculating PAYG Instalments on current revenue performance – more here.