The past few weeks have been full of many whispers regarding possible super changes following the announcement that the government was going to review the ‘objective’ of superannuation.

On 28th February, we got some confirmation that super changes were indeed going to be made to increase the tax rate on earnings within super that come from member’s balances over $3 million.

Before we get too tied up in the detail it’s important to remember that at this stage no draft legislation has been released or submitted to parliament and there is no law change. These types of changes involve consultation and ultimately are amended from their original form to get through parliament. The changes are proposed to take place from 1 July 2025, so there is also time to understand the final legislation and, if you are impacted, consider your options.

Put simply, the policy is to increase tax on earnings from 15% to 30% where those earnings are from the balance over $3 million. However the factsheet goes further to clarify how ‘earnings’ are calculated, and it is planned to calculate based on market movements of benefits – meaning it will include unrealised gains on assets not yet sold.

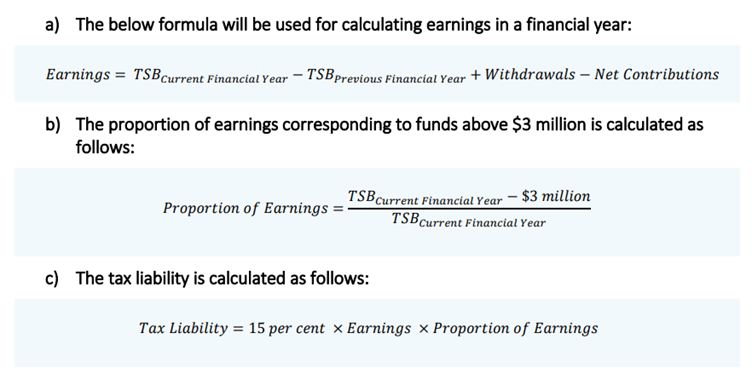

How is the tax proposed to be calculated?

The tax is proposed to be calculated by the ATO and will focus on a member’s Total Superannuation Balance (TSB)

The tax liability will be issued to the member, not the fund, and the member will then have the option to pay the tax personally or apply to their fund to pay the tax on their behalf. It is quite similar to how Div 293 tax currently operates.

What if the market goes down?

It is not uncommon for investments to go up and down. As earnings include market improvements, they will also include market corrections. Where a fund makes a loss for a year, the loss will carry forward to offset future income.

Who is impacted by the super changes?

Individuals with $3 million or more in superannuation will be impacted by these changes (the government say this is about 80,000 members currently).

However there are other implications to consider too:

- Couples who both have relatively high superannuation balances may find that one exceeds the 3 million cap upon the death of the other

- Super funds will need to better monitor valuations of property and unlisted investments, as values of these will now be included in ‘earnings’. This will affect all funds and it’s expected that the tax office will step up monitoring of how asset values are determined.

Without the final legislation it is difficult to plan what you may do if these measures impact you and strategies will be different for everyone.