We’ve been looking at how visualising your business numbers can help you make strategic decisions in your business, so today we’re looking at how to uncover your most profitable product to increase revenue.

Over the past two articles we’ve

– Broken down the information within a Profit and Loss

– Uncovered the two most common and highest expenditure items in businesses

During this process we’ve revealed that our case-study business needs to increase sales to better their profit position.

In this article we’re looking at how to decide where you should grow your sales.

Understanding your product mix

It is rare for a business to only sell one product or service. Take some time to consider your own business, what are all the different products and services you offer? Grab a piece of paper and write them down.

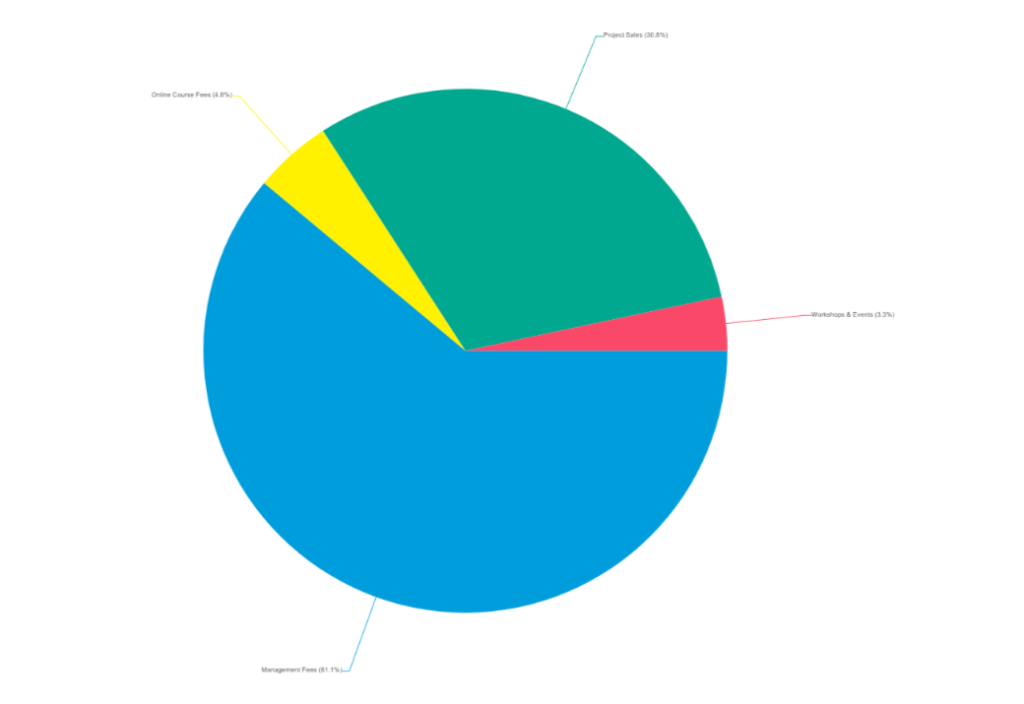

In our case-study the business has four product types

- Management Fees: ongoing retainer revenue

- Project Sales: one-off project revenue

- Workshops and Events: Face to Face training

- Online Course Fees:

The make up of total revenue is as follows – you can see that the majority of revenue comes from Management Fees and Project Sales.

So this business could increase sales in a variety of ways.

- They could focus on increasing sales across all their products equally

- They could zero in and focus on increasing sales on one specific product

- They could do a combination of the two.

Which product do you zero in on?

If they want to focus on a specific product, they need to work out which one will have the biggest impact/increase revenue; usually this is the one that carries the highest gross profit.

To work this out, you might have to do some digging in your financial data. What you want to find out is the average cost of delivering each product. If you don’t have a lot of information for your own products and services this is a good time to start thinking about what type of information you could need in the future and how you can capture this now, so that when it comes time for you to make a similar decision you have all the pieces of the puzzle on hand.

If you’re a product based business, you might want to start by having a list of all the products you sell, what does it cost you to buy or manufacture each product? What do you sell each product for – now work out your gross margin on each product. If you use an e-commerce plug-in a lot of this information might already be there for you, have a look at the insight dashboards available to you within your subscription.

For our case-study, they are a services business so most of their cost of sales is wages. With a services based business it then comes down to how that labour has been utilised. Is the business efficient with how it allocates staff hours, are some clients being over-serviced?

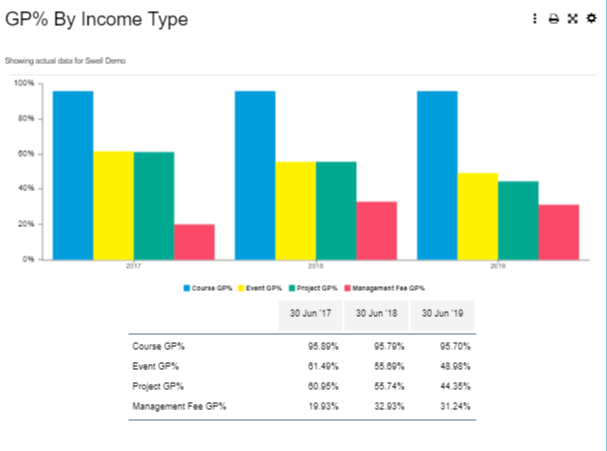

We’ve taken a look at the Gross Profit % for each service type over the past 3 years.

Here’s a summary of what we found

- Course revenue has the highest Gross Profit % – this isn’t a surprise, there are little overheads in delivering this service. Currently the business has the course listed on their website and they market it at their events as a low-cost way of working with them.

- Event Gross Profit has reduced – when we asked the business they said they had improved the quality of their events by hiring more up-market venues and spending more on marketing to get a greater audience.

- Project Gross Profit has declined somewhat – this could mean either they are winning more projects as they are more competitive in the market or they are not being as efficient with labour costs to projects that they had been in the past. The business said that they had reduced their prices to get more industry experience, and they feel that they could potentially increase price here by 5% and still be as competitive in the marketplace.

- Management Fee Gross Profit has improved – the business said that over time they got better at allocating labour for ongoing management retainers, in the start they were over-servicing clients, they identified this and where appropriate moved clients to a higher retainer level to reflect the service delivered.

Let’s recap what we know

The business has the majority of it’s revenue come from it’s least profitable product – management fees. This is good recurring revenue, but the business needs to either re-shape it’s product mix or improve margins on some products to further increase revenue.

Online Courses is the most profitable product at 95% but only makes up 5% of sales – this would be a good product to focus on, but the business needs to be aware that the total sale price is small so to have significant impact on revenue they would have to substantially increase unit sales.

Project sales are almost 15% more profitable than management fees but make up 50% less sales, the business has also mentioned that they think they could potentially increase prices here. Focusing on project sales growth could be the best strategy for this business to improve their revenue.

Next – we look at how to put the strategy together.

Need some help identifying where you should focus your sales growth or just better understanding your numbers? Our Cash Flow Forecasting Program, Swell is designed to grow your knowledge whilst simultaneously improving your business – book a complimentary consultation to explore how it works.