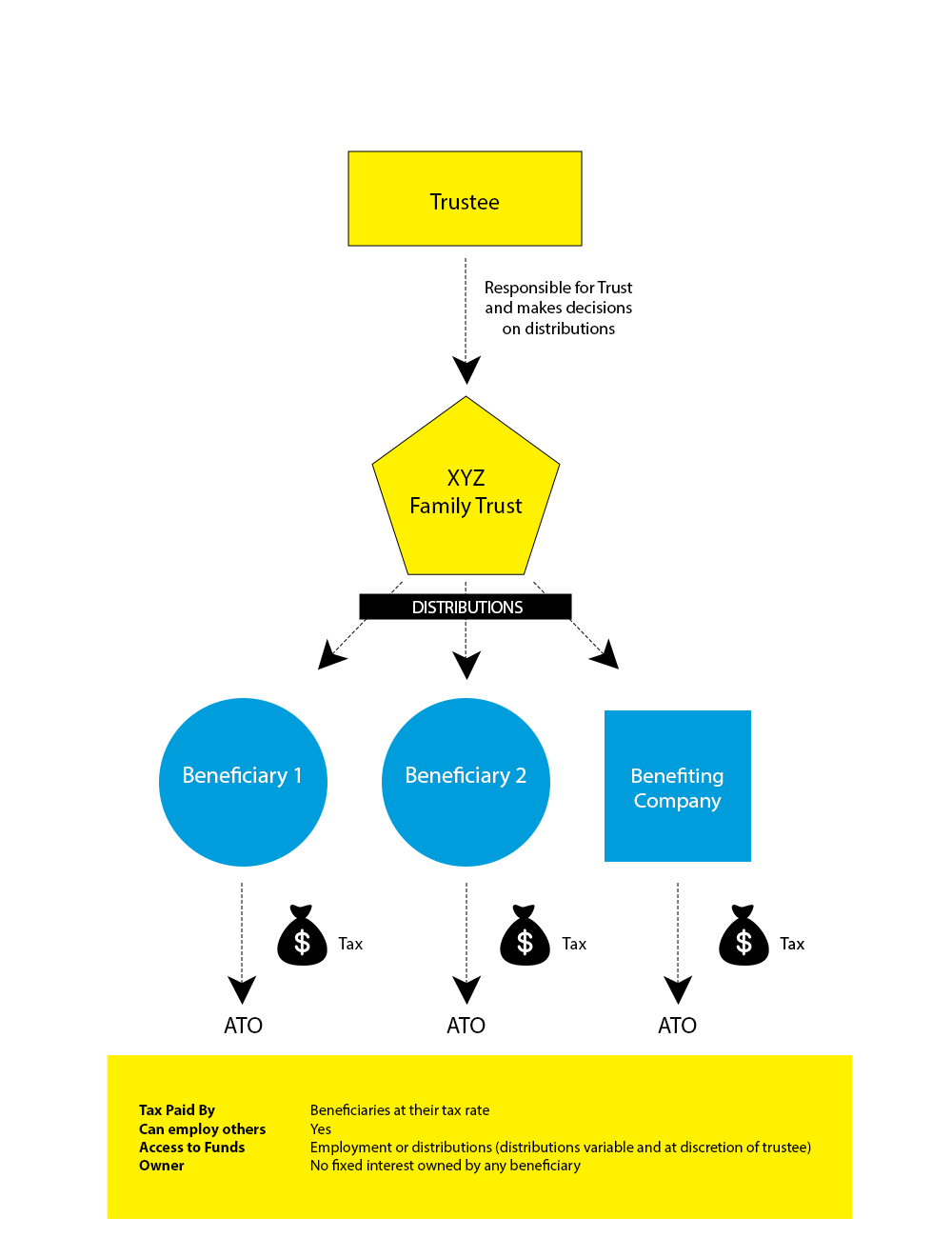

A Trust business structure is where there is an obligation imposed on a person (Trustee) to hold property or assets (such as business assets) for the benefit of others (Beneficiaries).

The trustee is legally responsible for the operation of the Trust and you may have a company act in this role.

Most Trust business structures are what are termed ‘discretionary Trusts’. This means that no beneficiary has a fixed ownership interest in income or capital.

The Trust must distribute any net profits or capital gains to beneficiaries each year, who then pay tax in their personal capacity. Failure to properly distribute profits can result in the trustee having to pay tax at the highest marginal tax rate. There are also requirements for funds to flow to beneficiaries within certain timeframes of distribution, for trading entities this can become difficult as cash is often utilised as working capital and tied up in business assets.

A Trust cannot distribute losses to beneficiaries, instead these are carried forward and offset against future profits.

What a trustee can do is governed by the Trust Deed – these are the rules of the Trust.

Why would you choose a Trust?

- Typically used for holding ‘investment’ interests such as shares or property.

- Suitable where there is no desire to have a fixed interest and instead would like flexibility in ownership and where tax is ultimately paid.

- Wanting to separate Trust Assets from Personal Assets – e.g for inter-generational wealth transfer and reducing risk of holding assets personally.

What else should you consider?

- Who will be named beneficiaries (see below)

- Who or what entity will act as Trustee and Appointor (see below)

- Ability to physically pay distributions (expected cash flow) – this is a key reason why we typically don’t recommend using a Trust for a trading business.

- Whether the beneficiaries of the Trust may need to be limited to a family group through a Family Trust Election.

- Usually applies if the Trust is receiving franked dividends and/or using carried forward losses.

- Not suitable for unrelated parties wishing to operate a business together.

- Ensuring any activities and asset purchases are correctly identified as held for the benefit of the Trust.

| Role | Responsibilities | Considerations |

|---|---|---|

| Trustee | • Person or entity responsible for the running of the trust. • Person or entity that is responsible for deciding how any profits or capital will be distributed. |

• Can be an individual or multiple individuals or a corporate entity. • If the trustee changes you may need to update records with third parties (e.g share registries, banks etc). |

| Appointer | • Role is to appoint or remove the trustee(s). | • Can be an individual or multiple individuals. |

| Settlor | • Provides the initial trust property (settlement sum). | • Can not be or become a beneficiary of the trust. Usually this is someone outside the family group. |

| Primary Beneficiaries | • Named Beneficiaries from which all other beneficiaries stem. • e.g. possible beneficiaries include the parents, grandparents, spouse, children, grandchildren, aunts, uncles of the named beneficiary + related entities. |

• Changing named beneficiaries can cause a trust resettlement and have significant tax consequences. |

What does a Trust structure look like?

What other business structures are there?

- Learn more about Sole Trader Structures

- Learn more about Partnership Structures

- Learn more about Company Structures

Our Services

To learn more about Lemonade Beach Accounting, Tax & Business Advisory Services, please follow the links below.