Determining your business structure is one of the first decisions to make as a new business owner. And it’s also one of the most important.

Each structure comes with its own set of benefits and liabilities. So, understanding how they will impact you day-to-day is key to building a solid foundation for your new business.

It is important to note that your needs, and therefore structure, may change as your business grows. However, a great place to start is to consider what your current and future needs may be.

Some things to consider include:

- Your business size and the industry you operate within

- What your tax obligations will be

- Your potential personal liability

- Asset protection

- The licences you require

- How much control / flexibility you’d like

- Ongoing costs and the amount of paperwork that comes with each structure type

TIP: As with most things in life there are pros and cons with each structure. To ensure that your personal circumstances are adequately considered against the complexities of each option we strongly suggest that you seek personalised advice before setting up any structure.

The Four Common Business Structures

There are four business structures commonly used in Australia. Here’s a quick crash course into what they are, when you would use them, and some things to consider when making any structure decisions.

While reading through the links above, you may have noticed that there is cross-over between the structure types. For example, you can have a Company act as some roles in a Trust, or as a partner in a Partnership. Similarly, a Trust may hold shares in a Company or be partner in a Partnership.

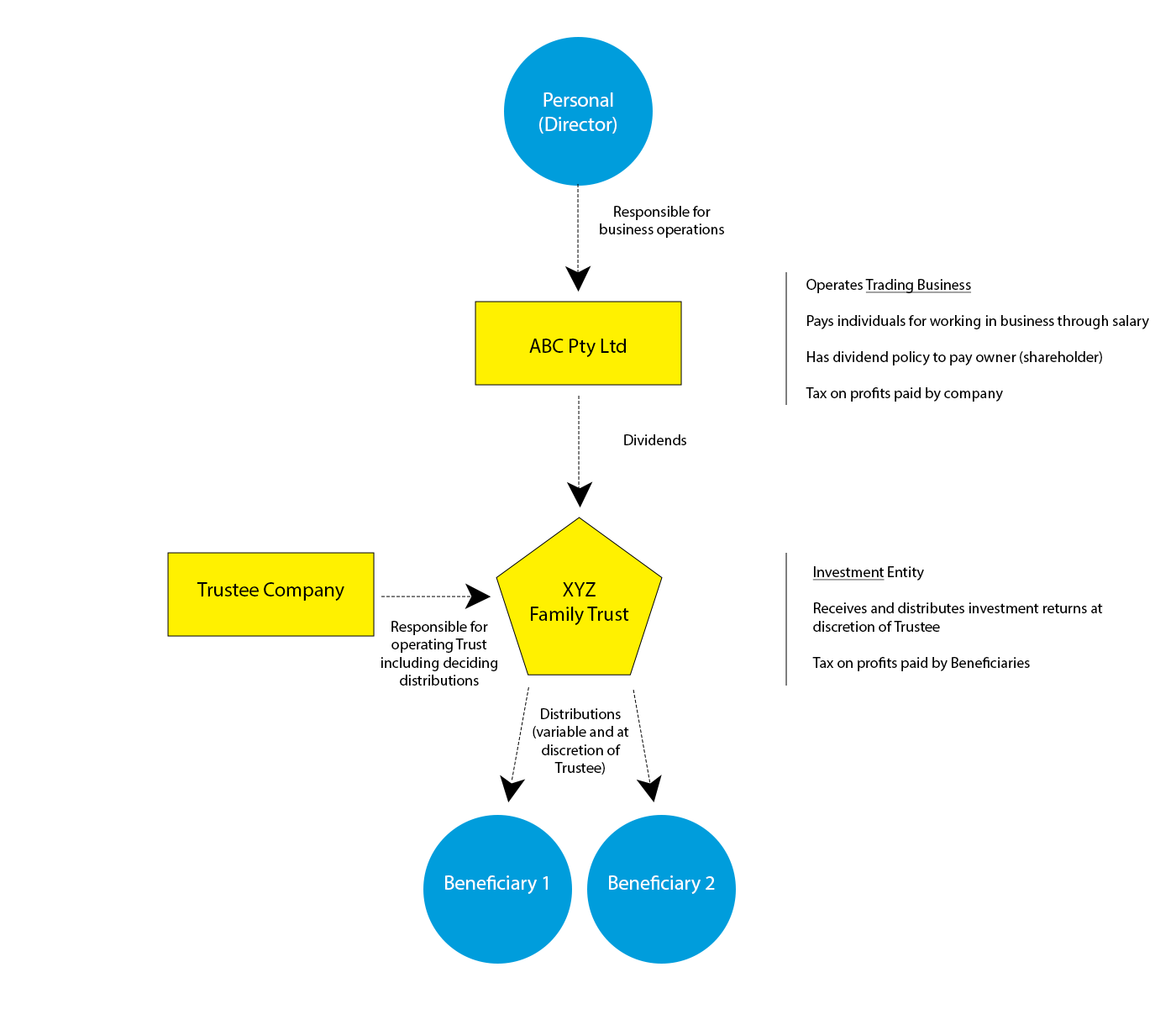

One of the most common business structures is a company operating the business with a trust as the shareholder. But why is that? Let’s take a look.

Companies with a Trust as the Shareholder

The reason this structure is utilised so much is due to the following:

- The trading entity (Company) has certainty with regards to

- Separate legal entity – providing separation of business risk from personal assets

- Fixed company tax rate.

- Can employ owners on a market salary. Meaning anyone actively working in the business gets rewarded for personal labour (including superannuation).

- Can access government grants such as R&D and EMDG.

- Flexibility on when dividends are declared.

- Can add additional owners (shareholders) through either issue of new equity or sale of existing shares.

- The Trust (shareholder) gains the following benefits

- Flexibility on where dividends received are distributed and taxed.

- Can purchase additional investments within the trust – building an inter-generational portfolio.

What does a Trust structure look like?

Our Services

To learn more about Lemonade Beach Accounting, Tax & Business Advisory Services, please follow the links below.