A company is a form of business structure. It is an entity that has a separate legal existence from its owners. This means it has the same rights as a person and can incur debt, sue and be sued.

Members (or shareholders) whilst the owners of the company, are not liable for the company’s debts. They only need to ensure they have paid up any amounts owing on their shares.

Directors however can be held personally liable for the company’s debts if it is found that they have breached their legal obligations.

Why would you choose a Company structure?

- Separate Legal Entity – provides a separation of business risk from personal affairs

- Ability to add new owners (shareholders) without causing a new entity to be established

- Fixed tax rate

- Ability to access government grants such as R&D and EMDG

What else should you consider?

- Company profits and assets are not yours as it is a separate legal entity – consider how you will draw funds from the company (usually through salary or dividends if shareholder). Any amounts drawn that exceed these amounts can be caught up in director/shareholder loan issues with further tax levied by the ATO.

- If you draw a salary the company needs to meet all employer obligations such as withholding tax and paying superannuation

- More complex record keeping requirements with need for financial statements and income tax returns.

- If there are multiple shareholders, you should consider how decisions will be made through documenting a ‘shareholders agreement’ (lawyer)

- Who will act in what role (see below)

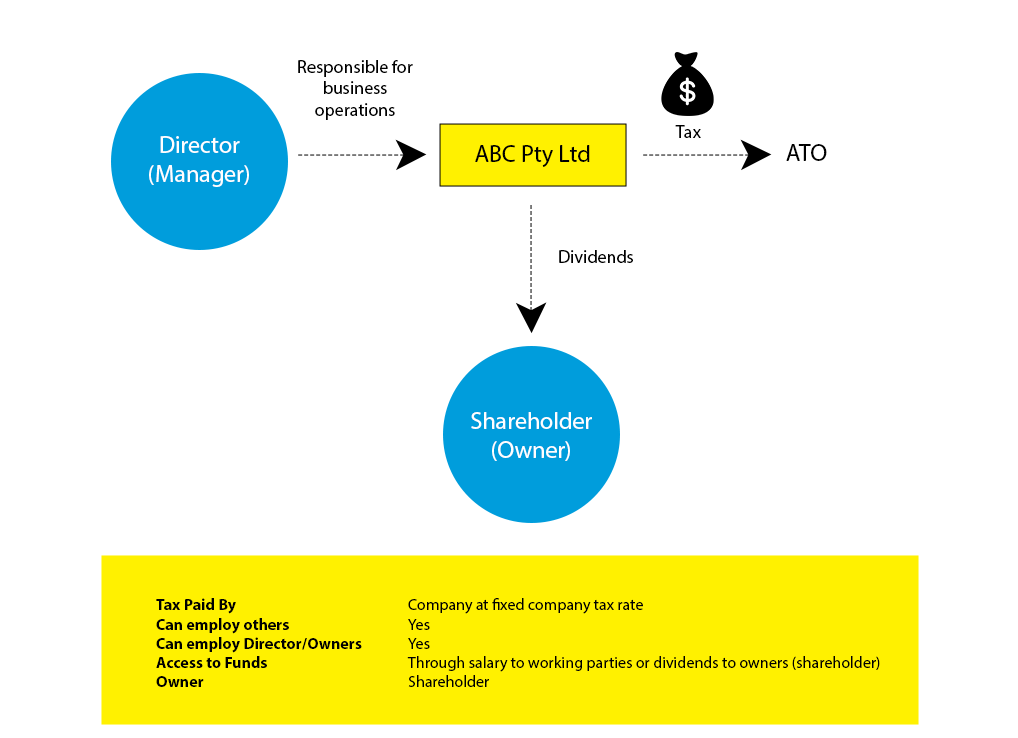

| Role | Responsibilities | Considerations |

|---|---|---|

| Director (s) | The Director(s) are responsible for the oversight of the affairs of the company. Director must know what the company is doing, including its financial position. The Director is ultimately responsible for ensuring the company can pay its debts as they fall due, including ATO accounts for income tax, GST, PAYGW and Superannuation Guarantee. | If a director knowingly allows the company to trade insolvently (where it cannot pay its debts) the director may be held personally liable for the company’s debts. |

| Shareholder (s) | The owners of the company. Voting rights depending on class of share they hold. Dividend and capital rights depending on class of share they hold. | Shareholder agreement. Who or what entity should hold your shares with regards to flexibility of how tax levied on future dividends or capital. Access to cgt concessions (if exit plan is to sell company shares) Do you need shares issued in multiple share classes (to restrict or stream dividends and voting rights?) |

What does a Company structure look like?

What other business structures are there?

- Learn more about Sole Trader Structures

- Learn more about Partnership Structures

- Learn more about Trust Structures

Our Services

To learn more about Lemonade Beach Accounting, Tax & Business Advisory Services, please follow the links below.