A Partnership business structure is made up of two or more people or entities.

Most small business Partnerships are what is termed ‘General Partnership’ – this means that all of the partners are equally responsible for the management of the business, and each has unlimited liability for the debts incurred.

A requirement of Partnership structures is that they need their own Tax File Number and ABN, and each partnership only lasts until there is a change in partners. For example, if you add or remove a partner, a new partnership is created, which requires a new tax file number and ABN.

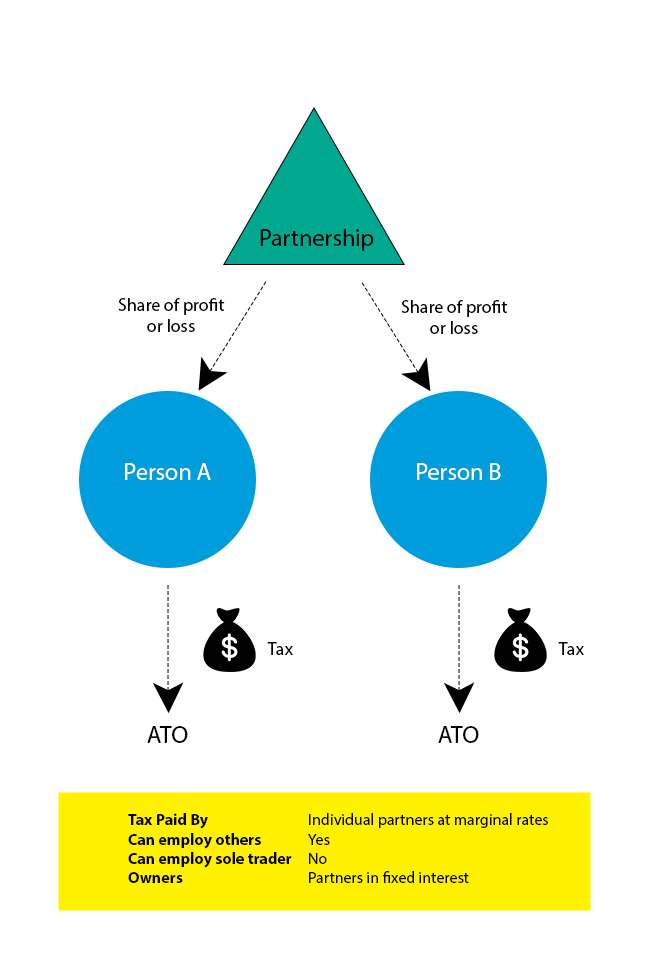

Each partner has a fixed interest in the partnership, and profits are distributed according to this interest at the end of the year. Tax is then paid at the individual partner level at the relevant rate.

Why would you choose a Partnership business structure?

- Spouses in business together where there is high level of trust

- Early stages of business and not sure if it will be a success

What else should you consider?

- Level of risk involved in business operations

- How / which entity type will hold your partnership interest

- Exposure risk to activities by other partners that are external to the business (partnership interest seen as a personal asset and therefore is treated as such should your partner get into financial difficulties personally)

- How decisions will be made – formation of ‘partnership agreement’ (lawyer)

- Whether you intend to add additional owners / partners in the future

- Ability to access some government grants (most require an entity to be a company)

What does a Partnership business structure look like?

What other business structures are there?

- Learn more about Sole Trader business structures

- Learn more about Company business structures

- Learn more about Trust business structures

Our Services

To learn more about Lemonade Beach Accounting, Tax & Business Advisory Services, please follow the links below.